STOCK CERTIFICATES ONLINE

What is Corporate Stock?

Corporate Stock is used by Corporations as a way to raise capital.

Anyone who buys Corporate Stock becomes a partial owner of the Corporation which issued the Corporate Stock.

Each share of Corporate Stock owned by an investor represents a proportionate share of interest in that Corporation.

Anyone who owns Corporate Stock is called a Shareholder of the Corporation.

A Corporation normally retains at least 51% of its Corporate Stock.

The remaining shares of Corporate Stock are sold directly by the Corporation to purchasers or on the open market through stock brokers.

Some shares of Corporate Stock are given directly to employees of the Corporation.

If one Shareholder owns more than 50% of all available Corporate Stock then that Shareholder will be able to determine the way in which the Corporation conducts business.

This is the reason why Corporations try to own (or control) more than half of their Corporate Stock.

A Shareholder who owns more than 50% of the Corporate Stock is called the Controlling or Majority Shareholder.

In return for purchasing Corporate Stock in the Corporation, the purchaser may be entitled to voting rights or dividends of the Corporation's profits depending on the type of Corporate Stock.

What are the main types of Corporate Stock?

There are usually two different types of Stock that a Corporation can issue, Common Stock and Preferred Stock.

Some states also allow a Corporation to also issue Undesignated Stock.

Common Stock is what Corporations normally issue to Shareholders. Preferred Stock, on the other hand is more like a bond or promissory note. Preferred Stock carries a fixed dividend percentage rate.

Common Stockholders receive a pro-rata share of the assets of the Corporation upon its dissolution if assets are available.

Common Stock can be voting, or non-voting.

Holders of voting Common Stock get to elect the Board of Directors of the Corporation, and thereby exercise control of the Corporation.

Holders of non-voting Common Stock do not get to elect the Board of Directors, but they still receive their pro-rata share of the Corporation's assets upon its dissolution if assets are available.

Common Stockholders may be eligible to receive dividends if Corporate profits allow.

Holders of Preferred Stock get paid dividends first. If there are profits left after paying the Preferred dividends, then dividends are paid to the Common Shareholders. That's why it's called Preferred Stock - dividends on it are paid first. There is a drawback, however.

As a trade-off for getting dividends first, Preferred Shareholders usually do not get to vote on matters affecting the Corporation. Preferred Stock is usually nonvoting.

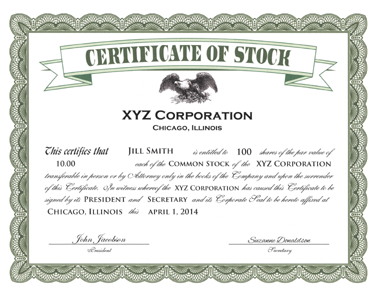

What is a Stock Certificate?

A

Stock Certificate is a legal document that certifies ownership of a specific number of stock shares in a Corporation.

A

Stock Certificate is also called a Certificate of Stock or a Share Certificate.

When you buy shares of Corporate Stock, a

Stock Certificate is sometimes issued.

Stock Certificates are signed by legal representatives of the Corporation which is issuing the Stock.

This is usually the Secretary and President/CEO.

A

Stock Certificate is evidence of ownership interest in a Corporation.

A

Stock Certificate may be issued for both Common Stock or Preferred Stock.

Ownership of Corporate Stock allows the owner (shareholder) to exercise all rights and privileges associated with being a shareholder in the Corporation, including voice and vote in shareholders meetings.

Ownership of a majority of shares allows the shareholders to run the Corporation as they see fit.

EXAMPLE OF A STOCK CERTIFICATE

How can I order Stock Certificates?

If you are ready to place an order for Stock Certificates Online now, simply enter your information into the fom below

then click the Place Order button.

If you get your order to us before noon local time we will prepare and mail your Stock Certificates to you by the next business day.

STOCK CERTIFICATES ORDER FORM