Wisconsin Secretary of State Good Standing Certificate

PLEASE NOTE:

In Wisconsin a Good Standing Certificate is called a

Certificate of Status.

This sometimes causes confusion when the requesting party, commonly the Secretary of State in another state besides Wisconsin, requests a "Good Standing Certificate". In these cases a Wisconsin Certificate of Status will fulfill the requirements for a Wisconsin Good Standing Certificate.

HAVE A COPY OF YOUR GOOD STANDING CERTIFICATE IN HAND IN

2-3 HOURS

- Priority - $78 - 2-3 hours

- Regular - $48 - next business day

What is a Wisconsin Good Standing Certificate?

A Wisconsin Good Standing Certificate is issued by the Wisconsin Department of Financial Institutions and is often required for

loans, to renew business licenses, or for tax or other business purposes in the state of Wisconsin or in any other state.

A Wisconsin Certificate of Good Standing is evidence that your Wisconsin business franchise - your Wisconsin

Corporation, LLC or LP -

is in Existence, is authorized to transact business in the state of Wisconsin, and complies with all state of Wisconsin business requirements

and therefore is in "Good Standing" in the state of Wisconsin.

Also known as a Wisconsin Certificate of Existence, a Wisconsin Certificate of Status or a Wisconsin

Certificate of Authority, a Wisconsin Good Standing Certificate is a one page document which looks like a letter and bears the seal of the state of

Wisconsin Department of Financial Institutions.

A Wisconsin Good Standing Certificate is provided by the Wisconsin Department of Financial Institutions and is conclusive evidence of the existence of your Wisconsin business

franchise.

In most cases a Wisconsin Certificate of Good Standing can be valid up to a year depending on the requirements of the Good Standing Certificate requester.

To obtain a Wisconsin Good Standing Certificate, your company must be registered as a legal entity with the Wisconsin Department of Financial Institutions, i.e., your company is in existence in the state of Wisconsin, and cannot be

in default of Wisconsin corporate rules, or suspended by the state of Wisconsin.

How much does it cost for a Wisconsin Good Standing Certificate?

Total cost for a Wisconsin Good Standing Certificate depends on how fast you need the Certificate.

You can get the EXACT fee using our Wisconsin Good Standing Cost Estimator.

With our Wisconsin Good Standing Certificate services there are:

- No Hidden Charges

- No Surprise Fees

- No Sign-Ups

What are the Requirements to be in Good Standing in the state of Wisconsin?

- The Wisconsin company must be registered as a legal entity with the Wisconsin Department of Financial Institutions as a Corporation, LLC or LP.

- The Wisconsin company cannot be in default or suspended as defined by the laws of the state of Wisconsin.

- The Wisconsin company must have filed all reports required by the Wisconsin Department of Financial Institutions or any other state of Wisconsin agency.

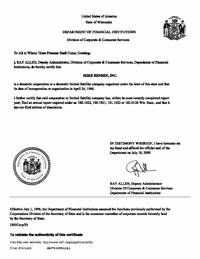

What does a Wisconsin Good Standing Certificate look like?

A Wisconsin Good Standing Certificate also called Wisconsin Certificate of Existence, is a one page document which looks like a letter and bears the seal and signature of the state of Wisconsin Department of Financial Institutions.

A Wisconsin Good Standing Certificate is proof positive that the WI Company named on the Certificate is legally eligible to do business in the state of Wisconsin.

What does it say on a Wisconsin Good Standing Certificate?

Some states verify that all taxes have been paid and all required reports have been filed.

Other states include bare minimum language that confirms only that a company is in existence and has not been dissolved.

Along with the issuance date and signature of the Wisconsin Department of Financial Institutions, a

Wisconsin Good Standing Certificate includes the following information:

To All to Whom These Presents Shall Come, Greeting:

I, SECRETARY OF STATE NAME, Administrator of the Division of Corporate and Consumer Services, Department of Financial Institutions, do hereby certify that

COMPANY NAME

is a domestic corporation or a domestic limited liability company organized under the laws of this state and that

its date of incorporation or organization is FORMATION DATE.

I further certify that said corporation or limited liability company has, within its most recently completed report year, filed an annual report required under ss. 180.1622, 180.1921, 181.1622 or 183.0120 Wis. Stats., and that it

has not filed articles of dissolution.

Wisconsin Certificate of Existence for Foreign Qualification in a state other than Wisconsin

A Corporation, LP or LLC that is registered in the state of Wisconsin may require a Wisconsin Good Standing Certificate to qualify as a

"Foreign Corporation" in a state other than Wisconsin.

A Foreign Corporation is a Corporation that is registered with a state agency, usually the Secretary of State, in one state and has the Authority to do business in another state.

For example, a Corporation registered in the state of California that plans to do business in the state of Wisconsin is a "

Domestic Corporation" in California and a

"

Foreign Corporation" in the state of Wisconsin.

All states require you to register as a Foreign Corporation with a state agency, usually the Secretary of State,

in order to do business in their state.

In order to register as a Foreign Corporation in any state you must provide evidence that you are registered and are in

Good Standing in another state as a Domestic Corporation or LLC.

This evidence is a Certificate of Good Standing from the state in which your Corporation or LLC was originally formed.

A Wisconsin Good Standing Certificate is legal and official proof of Good Standing from the Wisconsin Department of Financial Institutions.

All Business Documents provides full Foreign Qualification services in the state of Wisconsin as well as any other state.

What happens if a Wisconsin business is not in Good Standing?

If your Corporation, LLC or LP falls out of Good Standing with the WI Department of Financial Institutions it is technically illegal for your company to do business in the state of Wisconsin

or any other state.

This could lead to the piercing of the corporate veil and make the owners of the Wisconsin business liable for penalties and law suits.

In order to get back into Good Standing you will have to pay a Reinstatement Fee.

The cost to Reinstate a Wisconsin Company depends on the exactly why the Corporation, LLC or LP is not in Good Standing.

In some cases the fees for reinstatement of a Wisconsin Company may be more expensive that those for walking away from the business and

then creating an entirely new company.

Can I get a Wisconsin Certificate of Good Standing for a Sole Proprietorship or DBA?

A

Wisconsin Good Standing Certificate is issued by the Wisconsin Department of Financial Institutions for business entities that have registered

with the state of Wisconsin.

A Sole Proprietorship or DBA is not normally registered with the Wisconsin Department of Financial Institutions so a

Wisconsin Certificate of Good Standing cannot be issued for them.

If you own a Wisconsin business and have not registered as a Corporation, LLC, LP or other legal entity with the Wisconsin Department of Financial Institutions,

then you are a Sole Proprietor by default.

Nothing needs to be filed with the Wisconsin Department of Financial Institutions to create a Sole Proprietorship.

If you plan to use a name different from your first and last name then you would register in the Wisconsin county in which you do business

with your first and last name "Doing Business As" (DBA) the name of your business (for example: Sue Smith, DBA Sue's Wisconsin Business).

Are there other names for a Wisconsin Certificate of Good Standing?

In Wisconsin a Good Standing Certificate is called a

Certificate of Status. A Wisconsin Certificate of Status may be referred to by another name.

Other names for a Wisconsin Certificate of Status

- Wisconsin Certificate of Existence

- Wisconsin Certificate of Authority

- Wisconsin Certificate of Subsistence

- Wisconsin Certificate of Qualification

- Wisconsin Certificate of Compliance

- Wisconsin Good Standing Certificate

- Wisconsin Certificate of Standing

- Wisconsin Certificate of Authorization

- Wisconsin Certificate of Fact

- Wisconsin Letter of Good Standing

- Wisconsin Letter of Status

- Wisconsin Certificate of Good Standing

Does a Wisconsin Good Standing Certificate include a verification number?

Yes. Each Wisconsin Certificate of Status includes a unique Code which may be used to verify the Certificate with the Wisconsin Department of Financial Institutions.

Does a Wisconsin Good Standing Certificate include the Incorporation Date?

Yes.

A Wisconsin Good Standing Certificate includes the Date of Incorporation for a Wisconsin Corporation

or the Date of Organization for a Wisconsin LLC.

How long does it take to get a Wisconsin Certificate of Good Standing?

If you place your order for a Wisconsin Good Standing Certificate before 1 PM Wisconsin time we can get your Wisconsin Good Standing Certificate as fast as 2-3 hours.

We will send you a scanned copy of your Wisconsin Good Standing Certificate by email as soon as we

get it from the WI Department of Financial Institutions.

PLEASE NOTE:

WE CANNOT GUARANTEE WISCONSIN DEPARTMENT OF FINANCIAL INSTITUTIONS PROCESSING TIMES.

The Wisconsin Department of Financial Institutions reserves the right to extend expedite periods in time of extreme volume, staff shortage or equipment

malfunction.

We are dependent on, and have no control over, the staff and systems of the Wisconsin Department of Financial Institutions.

In our experience the time specified is the time it usually takes the Wisconsin Department of Financial Institutions to process Good Standing Certificate orders.

We get your Wisconsin Good Standing Certificate request to the WI Department of Financial Institutions ASAP.

Once it is at the state we have very little or no control over the Wisconsin Good Standing Certificate process.

How long is a Wisconsin Certificate of Good Standing valid?

A valid expiration date is not written on a Wisconsin Good Standing Certificate.

The validity of a Wisconsin Certificate of Good Standing is usually determined by the intended recipient of the Good Standing Certificate.

Some institutions may request that a Wisconsin Good Standing Certificate be less than a certain number of days old.

Generally the information included on a Wisconsin Certificate of Good Standing is implied to be valid for 60-90 days but it really

depends on the nature of the business for which the Wisconsin Good Standing Certificate is being used.

Each Wisconsin Good Standing Certificate comes with a Code.

A Wisconsin Certificate of Good Standing may be verified using the Code on the Wisconsin Department of Financial Institutions

web site.

We can email you a copy of your Wisconsin Good Standing Certificate the same day, usually within 2-3 hours after we get your order.

If the recipient of your Wisconsin Certificate of Good Standing requires official validation, they can go to the Wisconsin Department of Financial Institutions web site for

quick verification.

The web address to verify a Wisconsin Certificate of Good Standing on the Wisconsin Department of Financial Institutions web site is printed on

each Wisconsin Good Standing Certificate.

Wisconsin Tax Status Compliance Certificate

If you need to verify that all outstanding tax liabilities for a Wisconsin Corporation or Wisconsin LLC have been paid then you need

a Wisconsin Tax Status Compliance Certificate.

In Wisconsin a Tax Status Compliance Certificate is called a .

A Wisconsin is issued by the Wisconsin Department of Revenue and is sometimes called

a Tax Clearance Certificate or an Entity Status Letter or a Certificate of Account Status.

Wisconsin Attorney Good Standing Certificate

If you need a Good Standing Certificate from the highest Court in the state of Wisconsin for a Wisconsin Attorney we can help.

If you are ready to order a Wisconsin Good Standing Certificate, choose which Wisconsin

Good Standing Certificate options that you want below then click the Next Step button.

If you have any questions regarding our Wisconsin Good Standing Certificate services you can call us at

855-771-2477 or email us at

CorpServices@AllBizDocs.com.